Bitcoin recently reached new all time highs in the last few days, reaching nearly $90,000 per bitcoin. This comes as no surprise to OGs in the bitcoin community, and to much surprise from many others. Whenever a bitcoin bull run happens, you can regularly see articles talking both about bitcoin "surging" and "crashing" all in the same week. This is no surprise coming from a media industry that is ever more senationalistic. But because of this, Bitcoin will be showing up on the radar for more and more people who have never seriously considered a digital currency before. The days of finding people who haven’t heard of bitcoin are behind us at this point. Bitcoin may actually be the most important invention in the last 500 years. And since currencies both have government and economic implications, let me see how I can help…

Bitcoin is a cryptocurrency, which is a digital currency defined by a protocol designed using cryptography to keep the currency mathematically secure. For example if you send 1 bitcoin to Alice, she can verify that she received the bitcoin by using some software that does some math for her, and only Alice can then use that bitcoin by instructing her software to do some more math. This is very different than your usual currency, where you can only verify that you have received money by asking a trusted authority, like a bank. Even if you're using cash, you don't really know whether or not that cash is part of the $200 million in counterfeit money in circulation, unless you ask a bank or the government.

And this is the power of a cryptocurrencies: people can send each other money without involving a bank or a government. This is why a slogan often heard in the Bitcoin community is: "Be your own bank".

Bitcoin isn't the first digital currency, but it's a first-of-its-kind currency in a lot of different ways:

Transactions are irreversible. Only the holder of the wallet key (similar to a long password) can access the bitcoins in that wallet.

Cheap transactions. You can send someone $1 million for a fee of less than $2. Transactions used to be free, but have recently become somewhat expensive for day-to-day purchases. However, fees for low value transactions are around 1 cent using the Bitcoin lightning network.

The bitcoin network is decentralized. No central authority can print more bitcoins, freeze someone's account, or seize someone's coins. Bitcoin holders don't need to trust anyone in order to maintain or use their bitcoins, and any changes to the Bitcoin protocol can only happen if most people in the network agree to those changes.

No inflation. There will eventually be a maximum of 21 million Bitcoins, and about 95% of them already exist.

Bitcoin visionaries see Bitcoin as the first currency that will be truly global. A currency that can cross borders as easily as exchanging hands. A currency where spending 1 cent is just as cheap as spending $1000 or $1 million in minutes or seconds rather than days. Many also see the currency as en escape from government manipulation and a platform that can enable a huge assortment of new financial applications. In many ways, bitcoin has already achieved these things to a large degree.

There are 3 major things that Bitcoin is based on:

Cryptography

The Blockchain

Consensus Rules

Bitcoin's cryptography ensures that only you can spend your bitcoins. Bitcoin's blockchain ensures that all the transactions are recorded so that other people can verify that you sent them some bitcoin. And, importantly, Bitcoin's Consensus Rules can not be changed by any central authority, and instead, users can choose to or not to opt into changes.

But how does this all work? And why does this make Bitcoin worth real money?

Overview

If you don't want to understand anything about how Bitcoin technically works, go ahead and skip to the Value of a Bitcoin section.

If Alice wants to send Bob 1000 satoshi (0.00001 bitcoin), all she needs to do is ask Bob for his bitcoin wallet address, put that address into her wallet with the amount to send him (1000 sats), press "send", and (importantly) put her password/pin in that unlocks her wallet. Behind the scenes, what happens is:

Alice's wallet signs a message saying she's sending 1000 sats to Bob. This message is called a transaction.

Alice's wallet connects to her bitcoin node, which has connections to at least 8 computers in the bitcoin network.

Alice's bitcoin node sends that transaction message to all its connections.

Those computers then forward that transaction to their connections and so on, until pretty much everyone in the network has the transaction. At this point, Bob can probably see Alice's transaction and verify that it's valid. This may only have taken a few seconds. But Bob can't be 100% sure he has his money quite yet.

At this point, a miner has to create (aka "mine") a block containing Alice's transaction (more explanation below). Usually within the next 10-20 minutes, a miner will mine a block that contains Alice's transaction. This is called a "confirmation". Once this happens, Bob can pretty much be sure that Alice has successfully sent him his money, but the more confirmations Bob waits for, the more sure he can be.

After 6 confirmations (which happen within about an hour), it is statistically nearly impossible for the transaction to be reversed unless a massive entity that controls more than 50% of the bitcoin network is actively attacking the network.

Here's another video that well explains how bitcoin works.

To make it easier to think about the Bitcoin ecosystem, it should be helpful to draw parallels to the ecosystem of traditional currency.

Let's say Alice wants to give Bob 50 dollars with a check. She writes a check for $50 made out to Bob. Bob then goes and deposit the check at his bank (or with his phone, these days). This may seem simple enough, but there is more going on behind the scenes:

Alice has to keep track of her account so she can be sure the check won't bounce

Alice gives Bob the check

Bob deposits the check at his bank

Bob's bank looks at the the routing number on the check (Alice's bank), and figures out a transaction path to that bank.

Hopefully Bob's bank has a relationship with Alice's bank. If Alice and Bob have the same bank, the bank just removes $50 from Alice's account and adds $50 to Bob's account, easy. If they don't have the same bank, some extra steps are needed. And if the banks don't have a relationship, steps 6-12 need to happen between a central bank and both Bob's bank and Alice's bank. If a bank is small and doesn't have a relationship with the central bank, steps 6-12 need might need to happen between quite a few banks.

Assuming there is a direct relationship between the banks, Bob's bank then presents the check to Alice's bank.

Alice's bank then reviews the check and Alice's account, and agrees to pay after debiting Alice's account by $50.

Alice's bank adds $50 to their account for Bob's bank and informs Bob's bank that this happened.

Bob's bank then debits $50 from their account for Alice's bank, credits Bob's account by $50, then informs Alice's bank.

As a courtesy, many banks allow a small portion, say $100, of the check to be available for Bob as soon as the next business day.

The rest of the amount will only be available after 3-20 business days after regulation-required time has passed, and after the bank has had time to evaluate whether the check is fraudulent.

And this doesn't go into any of the headache that happens if a check bounces. Also, while cash my seem simpler to use, cash is easy to steal, and expensive to print and ship around in armored cars. Just printing currency costs the US government over $1.1 billion each year.

Banks used to regularly have reconcile their accounts by sending armored vehicles full of cash or gold from one physical bank vault to another, but electronic accounts with central banks (like the Fed) usually fulfill this role these days. Even dollars exist primarily in digital form these days, tho in a much different way than Bitcoin. Here's some more exposition about the problems with conducting transactions in dollars.

Cryptocurrency

So how does Bitcoin work as a cryptocurrency?

Essentially the entire point of cryptography is to find mathematical functions that are very difficult (ie time consuming) to reverse. It is very common to generate cryptographic values that would take thousands or millions of years to reverse with current technology. The two primary cryptographic techniques used in Bitcoin are:

Hashing - A hash function is a mathematical function that transforms a message into a much smaller message (the hash) that looks random (but isn’t). While the function is very fast to perform, it would take an incredibly long time to reverse (ie to find the original message from the hash). In Bitcoin, one of the things hashing is used for is to determine who gets to mine a block (details below).

Public Key Encryption - This is a technique that allows both secure communication through message encryption and identity verification (authentication) through signing. It is incredibly difficult to decrypt a message without having the private key, and its also incredibly difficult to create a signature that looks like it matches a public key without having access to the private key. In Bitcoin, signing is used to create verifiable transactions.

With normal (symmetric) encryption, both parties have a shared secret they use to both encrypt and decrypt messages:

With Public Key Encryption, instead of using just one key, there are 4 keys. Each party has two related keys, a public key and a private key. If you encrypt a message with your public key, only your private key can decrypt it. And if you sign a message with your private key, your public key can be used to verify that the signature was signed by you - the holder of your private key.

In Bitcoin, your wallet address comes from your public key, and you sign a message containing someone else's wallet address with your private key to create a transaction that will send someone bitcoin. Anyone can verify that you had the right to send that transaction by verifying the signature against your public wallet address.

Blockchain, Miners, and Proof of Work

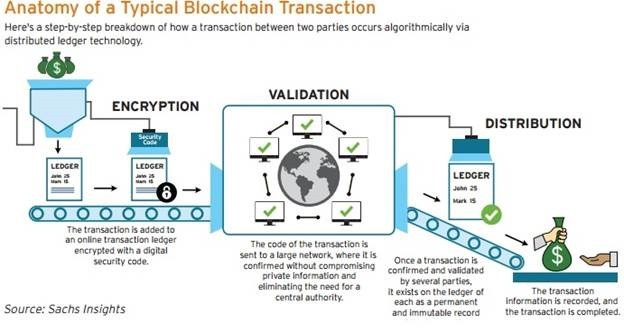

The blockchain is the record of all the bitcoin transactions that have ever taken place. If you want to know how many bitcoins are in your wallet, you can download the blockchain and count up your wallet's balance. The blockchain is created by miners - computers searching for crytpographic needles in a haystack.

A miner collects together a bunch of transactions that happened recently, adds the hash from the previous block, adds a random number, and then creates a hash of that data. If the hash is an acceptable value (as defined by the bitcoin protocol), the miner has found a valid block! A miner might do this billions or trillions of times (with a different random number each time) before finding a valid block. This acceptable hash is called the Proof of Work - ie the proof that the miner did the work to find the hash.

Because every block incorporates the last block's hash into its hash, these blocks become "chained" together so that every new block adds additional weight to older blocks, making blocks more set-in-stone the older they are. There are currently almost 900,000 blocks containing a total of over 1.1 billion transactions.

Mining provides two important things for Bitcoin:

It is the source of new bitcoins. All bitcoins currently in existence have been previously mined by miners.

Mining secures the network by making it costly to attack the network.

When a miner mines a block, they include a "coinbase transaction" to themselves which gives them some newly minted bitcoin. This is simply a transaction that grants a number of bitcoins to a particular wallet address (probably one owned by the miner). Currently, each block has a reward of 3.125 bitcoins or about $280,000. In addition, transactions have fees that users place onto them (to ensure their transaction is speedily added to the next block) and miners receive these fees as well. Currently, each new block contains around 0.2 bitcoins of fees, or about $18,000 per block. Because anyone can mine a block and receive the rewards, people are incentivized to mine blocks, which helps sustain the network.

Mining costs money to perform. Some of the biggest miners have huge server farms, and others are "mining pools" that simply provide an interface that users can connect to to contribute to mining the next block with their personal computers. Either way, a lot of computing power is needed to mine bitcoin blocks. As of November 2023, its estimated that Bitcoin miners were using about 17 gigawatts of electricity to mine Bitcoin blocks. This is enough electricity to power 13 million homes. This electricity costs probably less than $10 billion per year.

This might seem like a lot, but this cost is also what ensures that the blockchain is protected from attacks. The more money miners spend on mining blocks, the more money an attacker has to spend to disrupt the network.

If you join the Bitcoin network and don't trust anyone, a malicious computer can give you a blockchain and you would still be able to verify whether it is real or not by calculating how much "work" it took to create the blockchain. You could theoretically calculate approximately how much electricity (and therefore money) was used to create the blockchain an untrusted computer gave you. If the amount of work is too low, you know you have a fake blockchain.

Because its impossible to create a blockchain without sinking in all the mathematical effort to create it, it would be very very expensive to create a blockchain that could trick anyone. Someone trying to do this would have to be willing to let go of about $300,000 (the block reward + fees) in order to trick even the most gullible of victims (ie people waiting for only 1 confirmation). Someone trying to trick someone waiting for 2 confirmations would have to not only be willing to let go of $600,000 (twice the average block revenue), but would also have to own an enormous amount of computing power (at least as much as the computing power operated by the entire rest of the world's bitcoin miners).

This algorithm is called Proof of Work, because each block contains a proof that a certain amount of work was done to create that block. This is a key innovation that allows a public ledger of transactions to be trusted when downloaded from untrusted computers in a distributed network.

Consensus Rules

So now that you (hopefully) understand the cryptography for sending transactions and the blockchain that records and validates those transactions, the last piece is the governance of the protocol - the Consensus Rules. None of Bitcoin's mathematical security would matter if Bitcoin's developers could simply change the rules. Luckily, Bitcoin doesn't have a way to force anyone to change the Consensus Rules they use. Users must instead voluntarily opt into any suggested new rules by updating their software to a version with those rules.

Even if 90% of the Bitcoin network decides to update to a new version, if the other 10% don't want that change, they don't have to switch. If they do this, that 10% will basically create a 2nd currency that continues on from where the first left off, while the 90% will go in their own direction. This is a strong protection against large malicious actors, because as long as a significant minority of people still want to use the old Consensus Rules, they can. And this has actually happened.

There are two types of protocol changes:

Soft Forks - These are situations where new rules for creating blocks are added. Miners using the old protocol will still validate new blocks, but upgraded miners won't recognize old blocks as valid and won't mine on top of old-format blocks. No actual fork (aka chain-split) would happen. Bitcoin clients that aren't miners can continue using Bitcoin as normal after the change, but won't recognize new features from the upgrade until they themselves upgrade, which could lead to incorrectly calculating their balance if they’re sent transactions utilizing those new features but this maintains their security. The usual protocol policy generally requires 95% support from miners before soft forks "activate" (ie when the new protocol would go into effect).

Hard Forks - These are situations where rules for creating blocks are relaxed. Miners and normal clients using the old protocol will see new blocks as invalid, and thus will refuse to follow the new chain and continue following miners using old rules (if there are any), causing a chain-split. This means that all Bitcoin users also have to upgrade their client in order to use the upgraded Bitcoin. Bitcoin has never done an intentional hard fork.

Just like how constitutional provisions are stronger because they require super-majorities to change, Bitcoin's protocol is more stable because it requires a high level of agreement to make changes.

The Value of a Bitcoin

While the current price per bitcoin is around $90,000 (and will likely be completely different by the time you read this), each bitcoin can be divided into 100 million parts called Satoshi (the smallest unit of bitcoin), so even if the price per bitcoin was $10 million, each Satoshi would be worth a reasonably small 10 cents.

But is this price based on something real? Where does Bitcoin's value come from?

Bitcoin's value, and the value of any currency, comes from how useful it is in performing two basic functions of money: transferring money and storing value. Bitcoin has substantial benefits over something like the Dollar in various areas of money transfer and storing value.

So why would a bitcoin be worth $100,000 or more? Let me count the ways…

One relatively small way bitcoin will make a huge impact is as a credit card / debit card replacement. People have long talked about a world currency, and a large fraction of the Bitcoin community believe Bitcoin is it. Second layers on top of Bitcoin, like the Lightening Network, deliver on the promise of payments that complete in seconds and are nearly free. Bitcoin could become more usable than cash. But even if paying with bitcoin never quite makes it all the way into the main stream, its likely bitcoin will become the medium of settlement between larger institutions like banks and credit card companies. Credit cards are used to spend $43 trillion dollars every year. In the US, where over $10 trillion are spent every year via credit cards, transactions cost $125 billion dollars in merchant fees alone (not counting annual fees and other credit card costs) showing that at least 1.25% of each transaction goes to credit card companies. If credit card companies are overthrown by technologies like the lightning network, this would contribute around $10 billion (about a month's worth of credit swipe fees), which on its own would make a bitcoin worth $500.

Bitcoin is already making a significant impact in international transfers, which traditionally use wire transfers and remittances. Its estimated that over $4 trillion in cross-border payments were done using bitcoin in the past year. This is only 2.5% of the $190 trillion of cross-border payments, but its several times the size of the $626 billion of remittances in 2022 and the use of it will only grow. At costs of 6.35% on average, this means banks are pulling in almost $10 trillion from international transfers. Assuming the average cross-border payment is at least $1000, doing this with bitcoin would cost less than $380 billion (1/20th of the cost) because of transaction costs that are around $2, saving the world $9 trillion every year. If bitcoin eventually dominates cross-border payments, this single use case should eventually contribute to bitcoin's market cap (the total value of all bitcoins in circulation) to the tune of around $750 billion (savings from 1 month's international transfers). This alone would mean a bitcoin's value would be about $36,000 each.

Bitcoin's method of transaction finalization is far cheaper than the complex banking network and other institutional networks. This makes it much easier and cheaper for financial institutions to settle their debts to each other. If this happens, bitcoin could become the de facto world currency. If Bitcoin got as big as US dollars are today, that $21 trillion of M2 dollars would make each bitcoin worth $1 million each. And there's about $100 trillion of M2 money among all the worlds currencies. If Bitcoin's market cap got that big, that would mean a single bitcoin would be worth $5 million each.

But Bitcoin doesn't necessarily stop there. A huge portion of investments are made simply to beat inflation. Because Bitcoin has no inflation, its in a strong position to overtake these kinds of low-return investments. Gold is one of those investment instruments, and so are the private and government bond markets. These all have very low returns that struggle to beat inflation (even stocks may also be turning into this kind of investment). And, take a look at this mind-boggling chart of all the worlds money. Now bitcoin will never take over that whole chart, but look at that scary gigantic block representing the derivatives market. Surely 2008 has shown that a good portion of the estimated $600 trillion in derivatives might be toxic.

Gold has a market cap of $17.3 trillion, there is about $100 trillion in worldwide government debt, and another $130 trillion in private bonds. If half of these markets were supplanted by Bitcoin, one bitcoin would be worth about $6 million. And if just 20% of the derivatives market moved to Bitcoin instead, Bitcoin could be worth another $6 million each.

In total, the potential for a cryptocurrency like Bitcoin is almost $20 million per Bitcoin for a market capitalization of $420 trillion. Maybe Bitcoin won't be the currency that does this, or maybe multiple currencies will coexist to fill these use cases. But the potential is clearly there for some cryptocurrency or group of cryptocurrencies. And as time goes on, it seems increasingly likely that bitcoin will stay on top for quite a while longer.

And this is why Bitcoin's value is steadily rising at rates that make people think "bubble". But this is exactly what you would expect from an asset that has a real value 100 or 1000 times the market value. We would expect an exponential increase like this:

And we can sort of see the beginnings of something like the yellow or red lines there:

But when you look at the same data with a logarithmic scale, you can see a much more consistent exponential upward momentum that shows more clearly that Bitcoin isn't quite yet in bubble territory:

If you look at the slope of the line recently, its nowhere near as steep as it got in the earlier spikes (eg in 2013). I wouldn't be surprised if it spiked up to $200,000 over the next year before crashing back to $50,000. I was dead on last time I published a prediction like this (take a look, its interesting to look at the differences in numbers from 2017), but then again, I was wrong the time after that ; ) Hopefully a more steady trend continues without causing a spike or crash, but more likely the hype machine will cause some amount of boom and bust as it has throughout Bitcoin’s history.

Wider Implications

The fact that Bitcoin is a currency without inflation is incredibly important. This makes it a perfect store of value, but it also has wider economic implications.

The US government regularly reports inflation rates below 3%. Most people (especially economic writers) don't really understand inflation, but a great economist once said that "inflation is always and everywhere a monetary phenomenon". This means that changing the money supply (eg “printing money”) is the only significant factor that can cause a sustained change in inflation. Even if you believe the government isn't actively keeping their inflation statistics low, as many have suggested, this is still an extra 3% tax every year on all money: your savings and your paychecks. After just 10 years, a 3% inflation rate eats away over 30% of your bank savings.

"[As of 2012, the] dollar has fallen a staggering 86% in value since 1965." "[A return on investment of] 5.7% annually.. sounds satisfactory. But if an individual investor paid personal income taxes at a rate averaging 25%, this 5.7% return would have yielded nothing in the way of real income. This investor’s visible income tax would have stripped him of 1.4 points of the stated yield, and the invisible inflation tax would have devoured the remaining 4.3 points." - Warren Buffet

Well, today the dollar has falling by 91% of its 1965 value: only 9% left. Inflation is much more in the public eye since covid relief money and other government shenanigans nearly doubled the monetary base, putting about $3 trillion of extra base money into the economy. People can see the resulting price inflation in their lives, many basic items have nearly doubled from bread to eggs to rice. But inflation does not follow a simple line from cause to effect. Throughout history dating back millennia, currency devaluation often leads to a lesser amount of price inflation as most people aren’t really aware what new prices should be. Often this simply means we see small price increases but feel significant decreases in our quality of life, rather than seeing prices increase in lock step with monetary inflation.

And the US is nowhere near the biggest offender here. Argentina had bad inflation after 2008 and it has only gotten worse since then, regularly reaching 50% starting in 2018 and had an almost 300%/year inflation rate earlier this year. This is starting to look comparable to the period between 1975 and 1990 where the country's inflation averaged 300%, tho without peaks like the 20,000% hyperinflation in 1989…. yet. And this is often why bitcoin has been thriving in struggling countries like Argentina, and Venezuela. If bitcoin becomes the world currency, it would eliminate inflation, removing one major tool bad governments use to keep their citizens poor and big governments use to extract more money from their populace without transparency. This not only increases the currency's value, but would also lead to significant decreases in poverty worldwide.

Beyond simply an escape from inflation, Bitcoin being used as a world currency would also make it harder for governments to manipulate the market. Its widely understood that the Fed caused the Great Depression of 1929-1933, or at least greatly exacerbated it, by putting the bank clearinghouses (that previously mitigated panics) out of business and then refusing to lower a hiked up discount rate when banks needed loans most. Many believe that the Fed makes business cycles worse and there is evidence that Fed activities increase inequality. Many Bitcoin enthusiasts believe that taking monetary control away from government will be a major factor that stabilizes the economy, making huge market crashes a thing of the past.

Conclusion

I've described how Bitcoin currently works and analyzed a bit why some people think Bitcoin is a rocket to the moon. It clearly has a number of major advantages over classical currency, which makes it all but certain that it (or some currency like it) will be a major player in some form in the next 100 years.

Next post, I'll go over some practical things like wallets, back ups, ETFs, the lightning network, and a short discussion of altcoins.

If you want more explanations of various things related to bitcoin, here is a list of the best explanations of Bitcoin and related cryptocurrencies.